- FAQs

- Download Forms

- Payment Facilities

- Education

- Investments / Savings

- Pension / Retirement

- Medical

individual insurance

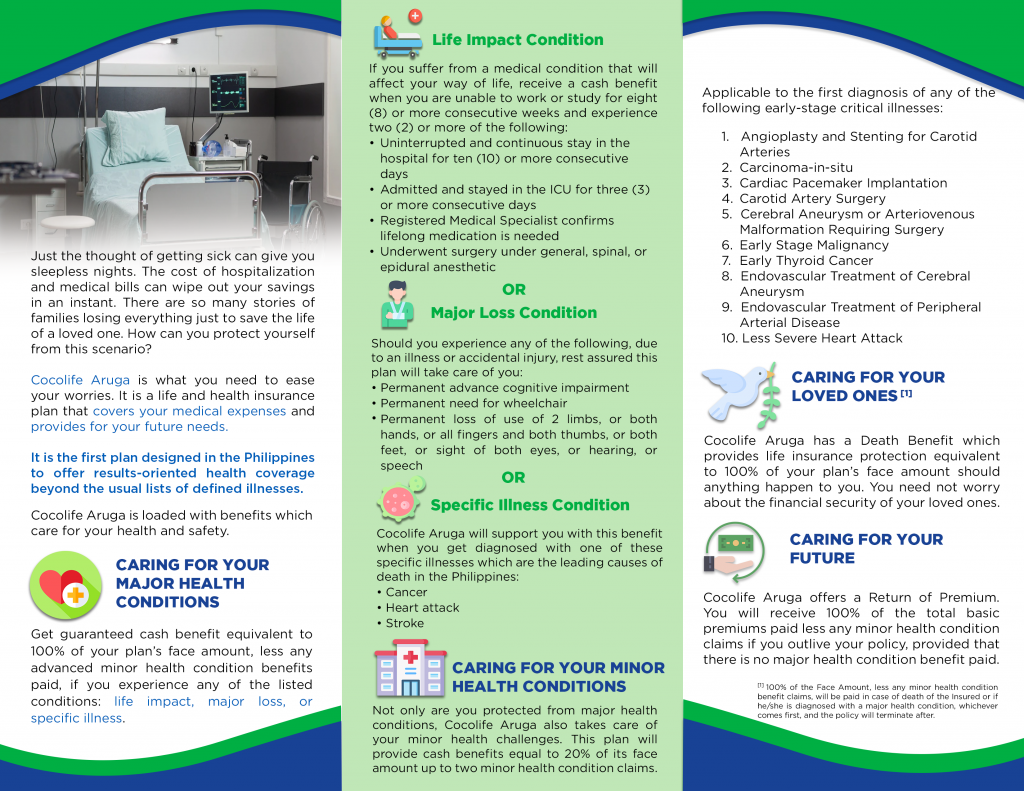

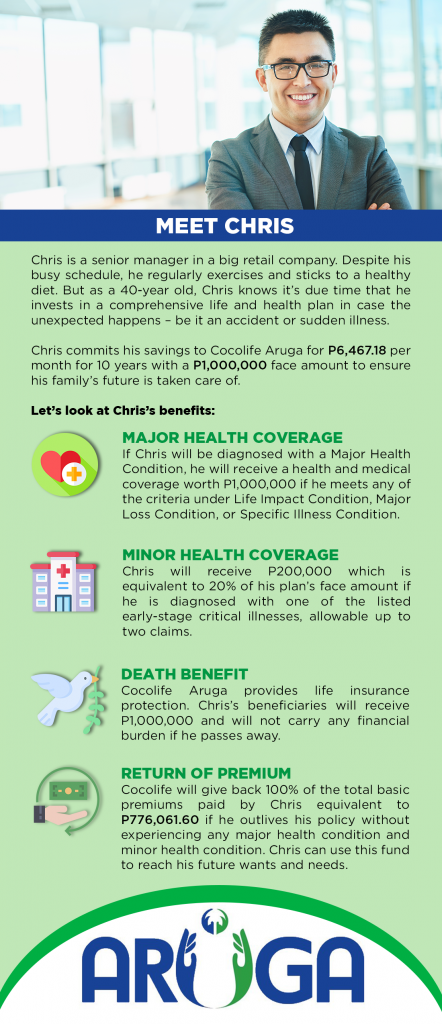

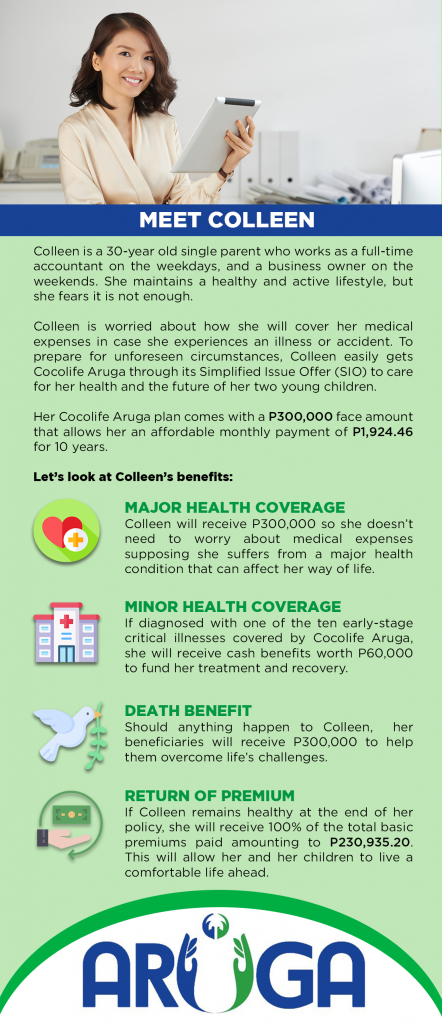

COCOLIFE ARUGA

This is what you need to ease your worries. It is life and health insurance plan that covers your medical expenses and provides for your future needs.

It is the first plan designed in the Philippines to offer results-oriented health coverage beyond the usual lists of defined illnesses.

Cocolife Aruga is loaded with benefits which care for your health and safety.

-

Covers medical expenses

-

Provides for future needs

-

10-pay to 20-pay

Simplified Issue Offer and Regular Underwriting

-

Until age 85

Duration of Coverage

-

0-50 years old

Age Requirement

WHAT IS THIS PRODUCT ALL ABOUT?

Cocolife Aruga is available for a minimum face amount of P300,00 and a maximum face amount of P5,000,000

individual insurance

protection

Anything can happen, whether you are just starting your career or raising your own family. Should something unfortunate happen to you, what happens to your loved ones?

Live worry-free when you know your family’s financial future is secure. Protect your income and take care of your family’s financial well-being with Cocolife.

-

Guaranteed life insurance protection

-

Renewable and convertible to permanent plan

Payment Period

-

1, 10 or 20 years

Payment Period

-

1, 10 or 20 years, or up to age 65

Duration of Coverage

-

18-60

Age Requirement

WHAT IS THIS PRODUCT ALL ABOUT?

Have peace of mind with a renewable and affordable insurance plan that suits your budget and financial goals.

Now, your family’s financial needs will be taken care of with Term Shield!

Term life insurance

With flexible options, you can renew your coverage and customize your plan for as low as P 13 a day!

-

Accidental Death Benefit

-

Accidental Disablement of Loss of Use

-

Burial Benefit Due to Accident Death

Cocolife Protect

-

Burial Benefit Due to Any Cause

Cocolife Protect Plus

-

Accidental Medical Expense Reimbursement

*Optional

WHAT IS THIS PRODUCT ALL ABOUT?

Cocolife Protect and Protect Plus are designed as affordable and comprehensive protection plans that provide financial security in the event of an accident resulting in injury, disability or death.

income protector

In case you get sick or incapacitated, FLEXI will provide you with cash benefits to help you cope financially. No need to worry since FLEXI allows you to withdraw anytime.

-

10 or 20 years

Payment Period

-

Until age 100

Duration of Coverage

-

1-55 years old*

Age Requirement

WHAT IS THIS PRODUCT ALL ABOUT?

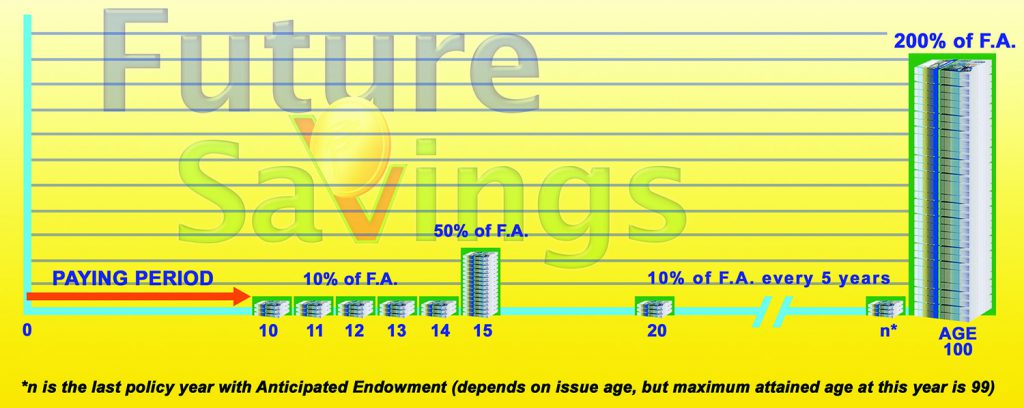

Future Savings Platinum is a special financial plan that lets you enjoy more than 200% life insurance protection plus guaranteed cash bonuses.

This plan provides you with optimum insurance protection, freeing your loved ones from financial woes in the event of sudden loss. It doubles the payment to beneficiaries upon the insured's passing prior to age 100.

Future Savings Platinum rewards you as much as 200% of your Face Amount upon maturity should the insured survive up to age 100.

This product is exclusively available for Mall Clients.

*Age requirement of 1-60 for Gold

-

5, 7, 10, 15, 20 years or

regular-payPayment Period

-

Until age 100

Duration of Coverage

-

1-70 years old*

Age Requirement

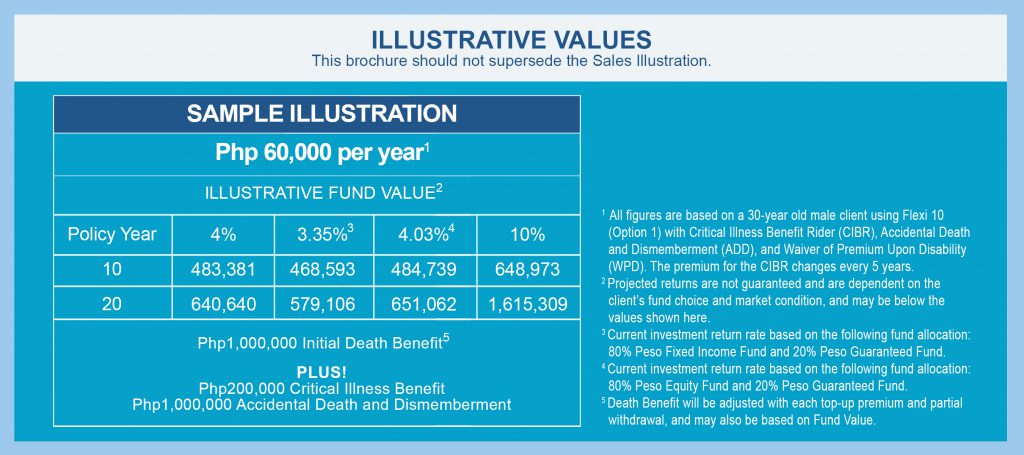

WHAT IS THIS PRODUCT ALL ABOUT?

FLEXI Protection is a variable life insurance plan that gives you the freedom to design your investment and insurance plan according to your needs. You'll get a highly customized plan with additional benefits tailor-fit to your goals in life.

income protector

In case you get sick or incapacitated, FLEXI will provide you with cash benefits to help you cope financially. No need to worry since FLEXI allows you to withdraw anytime.

*Age Requirement of 1-65 for 5-pay

individual insurance

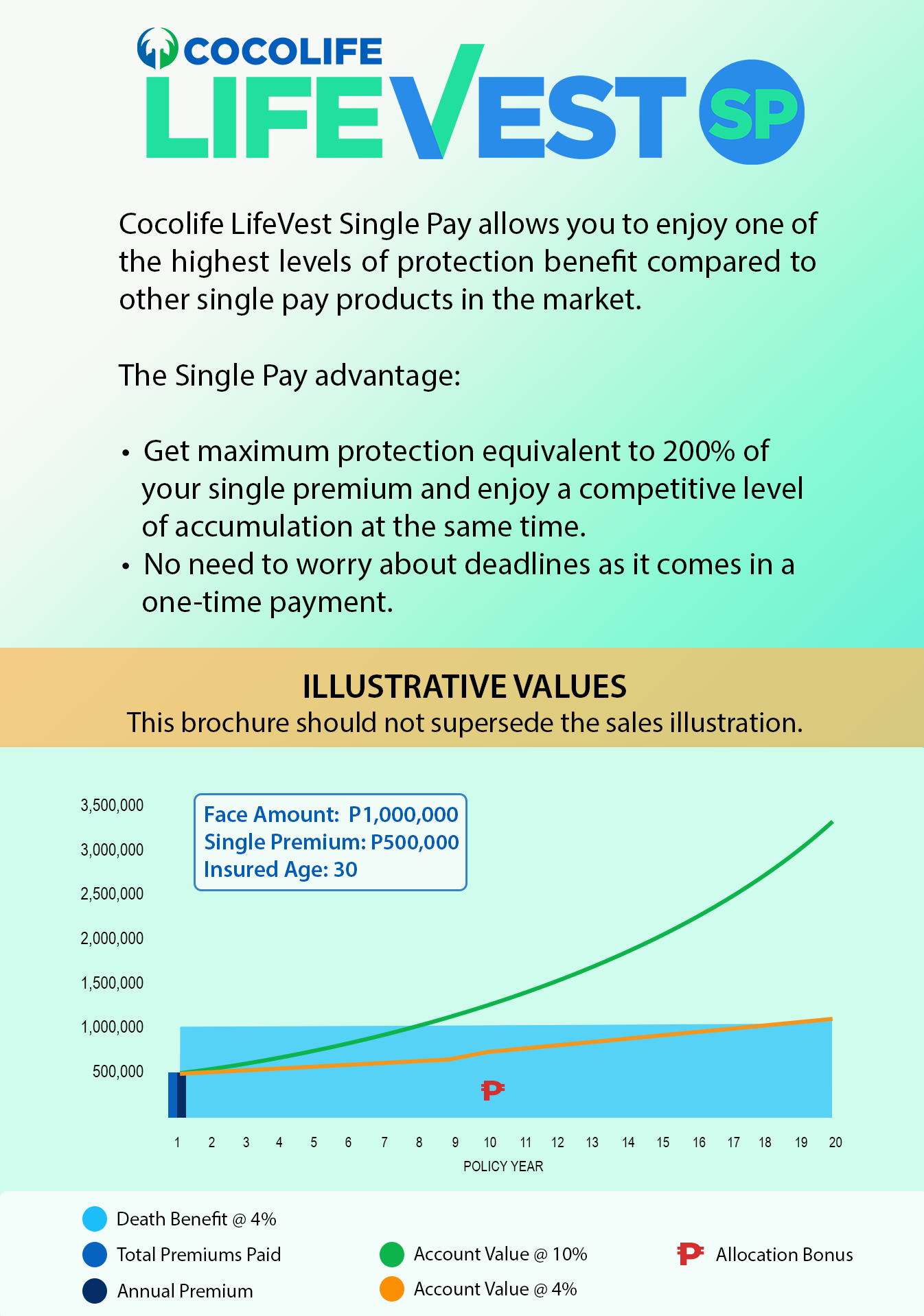

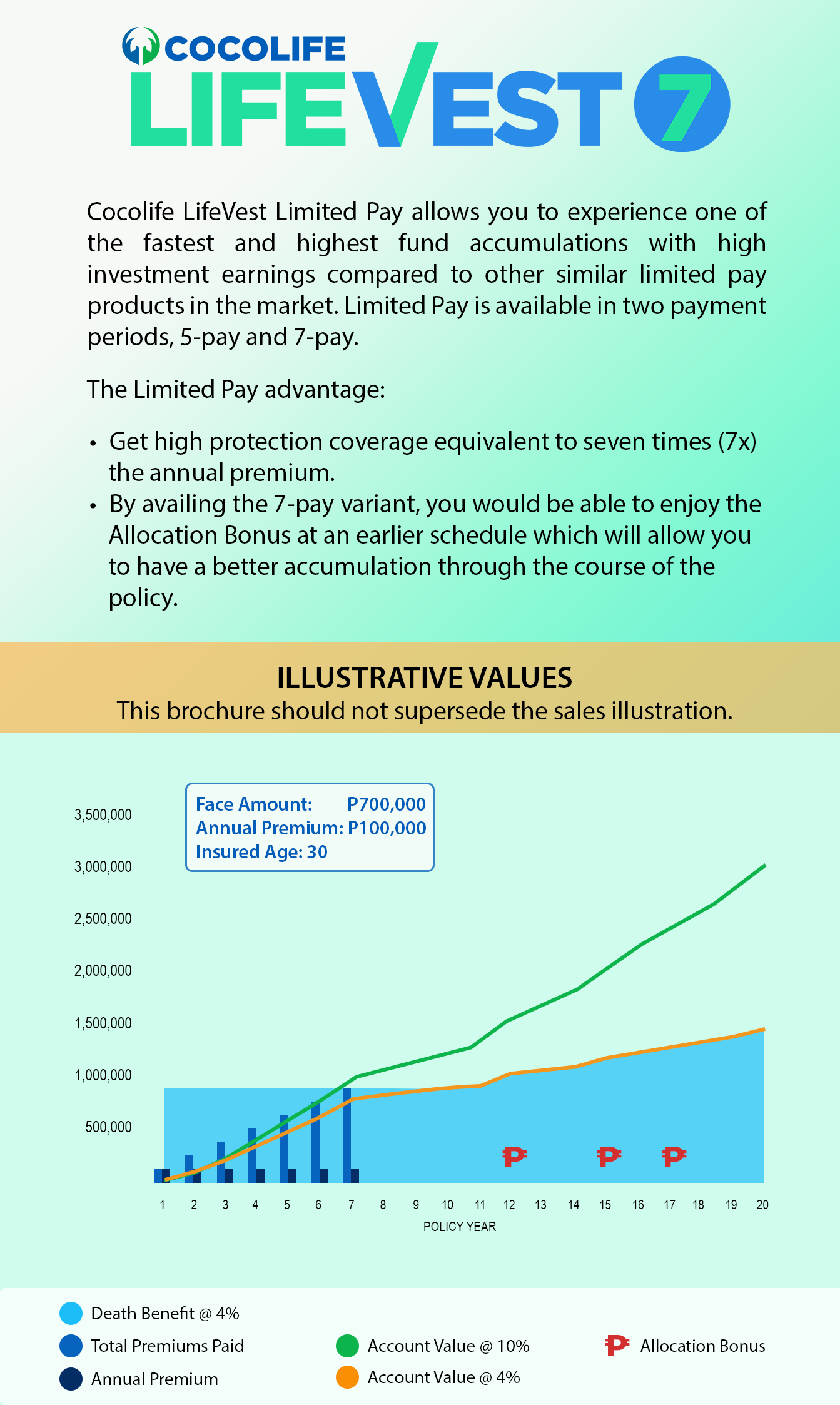

LIFEVEST

Your family’s security comes first whether you’re a young professional, a parent or an executive. Get protected in times of uncertainty while growing your savings.

Have peace of mind and rise above life’s challenges with Cocolife LifeVest.

-

Maximum protection coverage

-

Competitive fund earnings

-

Single Pay and Limited Pay (5 or 7 years)

Payment Period

-

Until age 100

Duration of Coverage

-

0-50 years old*

Age Requirement

WHAT IS THIS PRODUCT ALL ABOUT?

LifeVest is an affordable investment-linked life insurance plan that provides the perfect balance between savings and protection. Now, you can protect your family from financial burden while growing your investment.

Savings growth and protection

Take charge of your protection and investment with this reliable lifesaver.

*0-45 for 5-pay, 0-55 for 7-pay

individual insurance

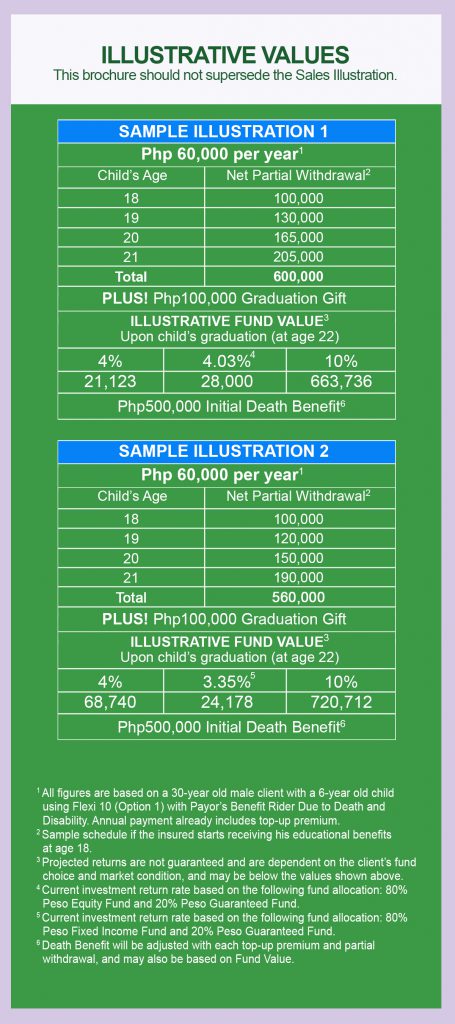

education

Give your child the brightest future he deserves with Cocolife’s FLEXI Education.

This disciplined savings and investment program is designed to prepare for your child’s college education so you can ensure he fulfills his dreams.

-

5, 7, 10, 15, 20 years or

regular-payPayment Period

-

Until age 100

Duration of Coverage

-

1-70 years old*

Age Requirement

WHAT IS THIS PRODUCT ALL ABOUT?

FLEXI is a variable life insurance plan that gives you the freedom to design your investment and insurance plan according to your needs. You'll get a highly customized plan with additional benefits tailor-fit to your goals in life.

EDUCATION

Use your earnings from FLEXI to support your child's education.

*Age Requirement of 1-65 for 5-pay

individual insurance

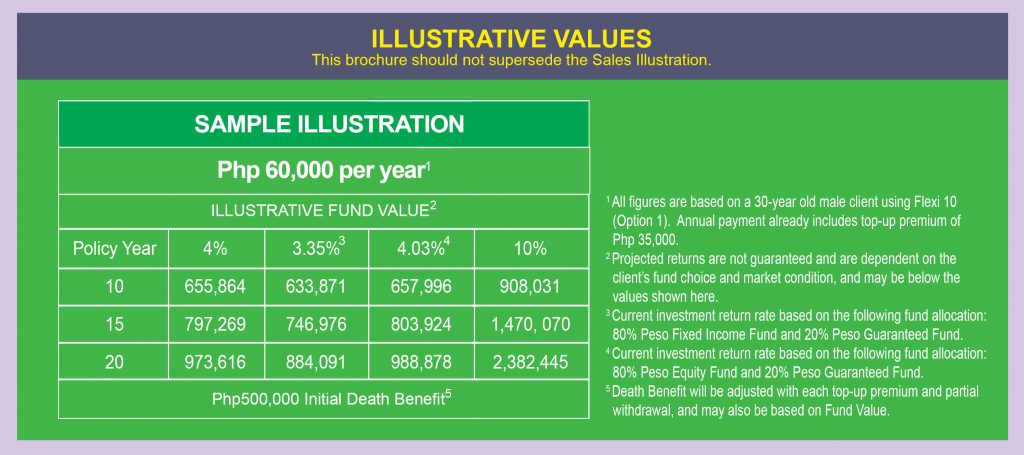

Investment

If you dream of a lavish destination wedding, a brand-new SUV, or a fully-furnished house in an exclusive village, then Cocolife can help you make it real.

Start building funds for major purchases like the equity for your dream house, or the start-up capital for your very own business with FLEXI.

-

5, 7, 10, 15, 20 years or regular-pay

Payment Period

-

Until age 100

Duration of Coverage

-

1-70 years old*

Age Requirement

WHAT IS THIS PRODUCT ALL ABOUT?

FLEXI is a variable life insurance plan that gives you the freedom to design your investment and insurance plan according to your needs. You'll get a highly customized plan with additional benefits tailor-fit to your goals in life.

investment

FLEXI is a good investment vehicle that will help you grow your money.

*Age Requirement of 1-65 for 5-pay

individual insurance

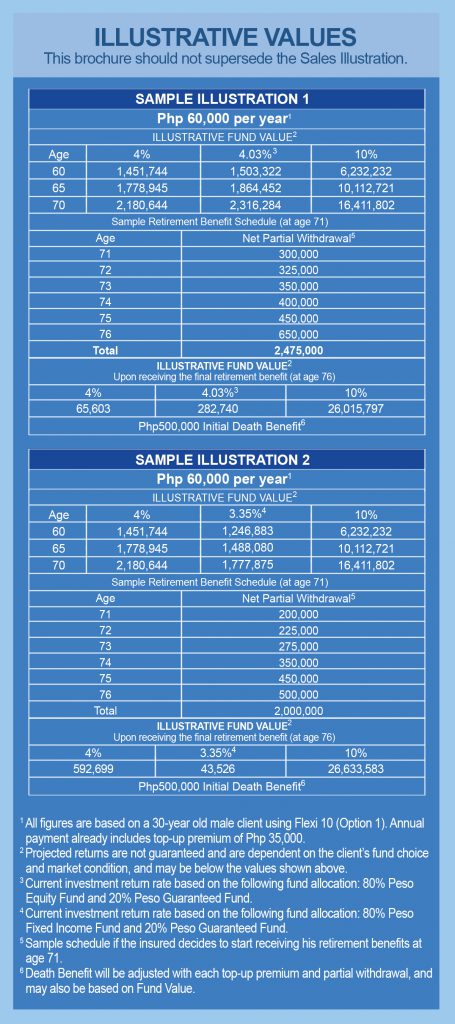

Pension / Retirement

Anything can happen, whether you are raising your own family or entering retirement. Should something unfortunate happen to you, what happens to your loved ones?

Secure your family’s future and help them financially cope with Cocolife FLEXI Retirement.

-

5, 7, 10, 15, 20 years or

regular-payPayment Period

-

Until age 100

Duration of Coverage

-

1-70 years old*

Age Requirement

WHAT IS THIS PRODUCT ALL ABOUT?

FLEXI is a variable life insurance plan that gives you the freedom to design your investment and insurance plan according to your needs. You'll get a highly customized plan with additional benefits tailor-fit to your goals in life.

*Age Requirement of 1-65 for 5-pay

INCOME PROTECTOR

In case you get sick or incapacitated, FLEXI will provide you with cash benefits to help you cope financially. No need to worry because FLEXI allows you to withdraw anytime.

RETIREMENT

FLEXI provides you with funds so you can retire comfortably.

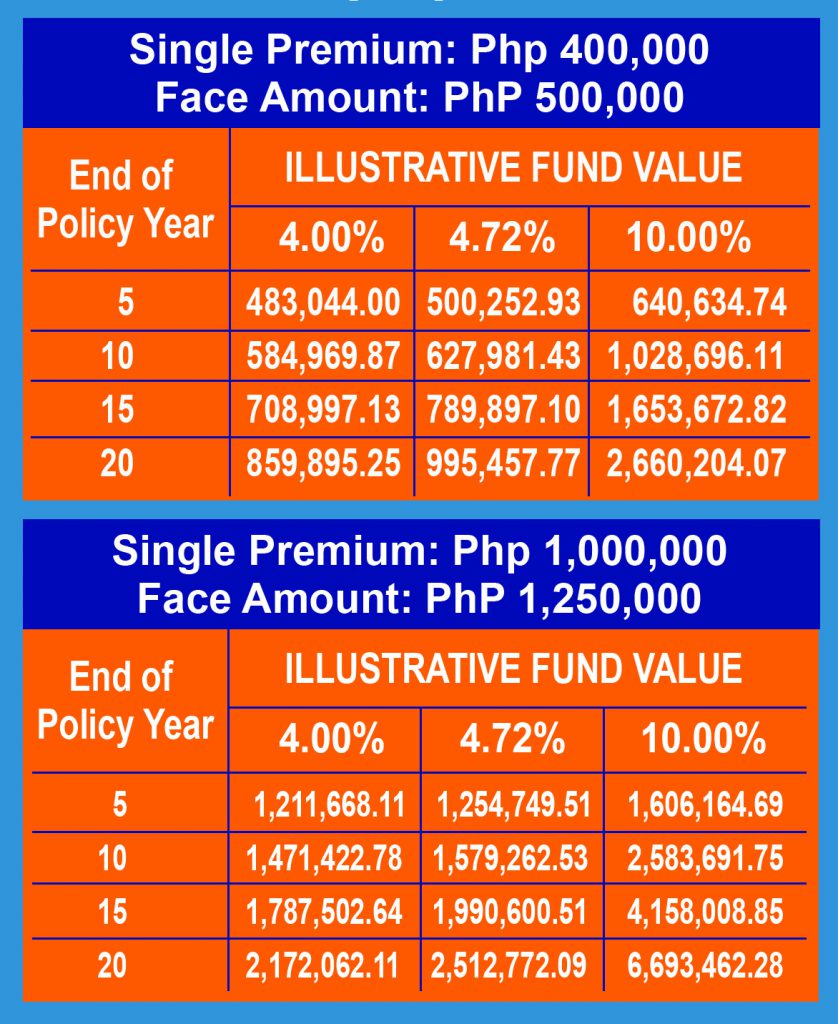

individual insurance

medical

Health is wealth. The best gift we can ever have is to have a healthy body that allows us to enjoy everything that life has to offer. With good health, we can fulfill our goals and live a full life.

Let us take good care of our health. Eat the right foods, have enough sleep, and get some exercise. To ensure that we are well-protected, we must start investing for our health.

Cocolife has several investment funds that offer high returns which you can allocate for future medical needs. Take good care of your health now and let Cocolife take care of you in the event of an emergency.

-

Single-pay

Payment Period

-

Until age 100

Duration of Coverage

-

1-70 years old

Age Requirement

WHAT IS THIS PRODUCT ALL ABOUT?

Cocolife Zenith Med is the only plan in the market that allows you access to high investment returns and exclusive access to the widest network of accredited hospitals of Cocolife Healthcare.

MEDICAL

There is no premium charge, so you can accumulate funds faster for future medical needs.

BIG ON BENEFITS

CONVENIENCE. In case you get hospitalized, there is no need to withdraw cash. Just present your Cocolife Healthcare Card to any accredited hospital and our Cocolife Liaison Officers will handle all your requirements.

Up to 75% of Fund Value will be allotted in case of hospitalization.

LOWER MEDICAL COSTS. Enjoy lower/preferential rates for medical services due to the existing tie-up of Cocolife Healthcare with accredited hospitals.

NO PRE-EXISTING CONDITIONS. You can use your Zenith Med plan for any type of hospitalization including maternity, critical illnesses, major hospitalization and emergency cases.