Self-care plays an essential role more than ever before, especially in safeguarding yourself against life-threatening health problems. According to a recent report by the Philippine Statistics Agency, the top fatal illnesses in the country include heart attack, stroke, COVID-19, cancer, diabetes, and hypertensive disease. Contracting any from the list puts households one sickness away from financial catastrophe.

Aside from maintaining a healthy lifestyle, it is crucial to have a plan that financially prepares you to get ahead of tomorrow.

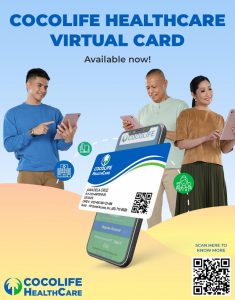

The latest offering from Cocolife, the biggest Filipino-owned stock life insurance company and the first ISO-certified Filipino insurance company, is ready to equip Filipinos and their loved ones with protection from unexpected health situations.

Designed by a Filipino insurer, Cocolife Aruga is a first-of-its-kind plan that offers results-oriented health coverage beyond the usual lists of defined illnesses. It is a life and health insurance plan that covers your medical expenses and provides for your future needs.

Cocolife Aruga gives coverage until age 85 and has four primary benefits: benefits for major and minor health conditions, death benefit, and return of premium for clients.

Read the full feature on Business World here.